Malaysia Personal Income Tax Rate is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a max of 28. 2017 law versus 2018 tax reform tax reform rate cuts.

Individual Income Tax In Malaysia For Expatriates

All foreign-sourced income of all Malaysian tax residents individuals who carry on business through a partnership.

. Masuzi October 20 2018 Uncategorized Leave a comment 3 Views. Printed in Malaysia by SP-Muda Printing Services Sdn Bhd 906732-M 82 83 Jalan KIP 9 Taman Perindustrian KIP Kepong 52200 Kuala Lumpur. Not only are the rates 2 lower for those who has a chargeable income between RM20000 and RM70000 the maximum tax rate for each.

Introduction Individual Income Tax. A non-resident individual is taxed at a flat rate of 30 on total taxable income. Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News Corporation Tax Europe 2021 Statista.

On the First 5000 Next 15000. The new lifestyle tax is not exactly new. Malaysia Personal Income Tax Rate 2017 Table.

The decision on how. Personal income tax rates. The Malaysian 2016 budget increased tax rates between 2015 and 2016 raising the maximum an individual could pay to 28 percent from its earlier 25 percent.

The basic distinction in the tax treatment of an individual who is a resident or a non-resident of Malaysia is as follows. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at. Malaysia located in Southeast Asia is separated by the South China Sea into two non-contiguous regions.

Home Uncategorized Malaysia Tax Rate Table 2017. Rate TaxRM A. These will be relevant for filing personal income tax 2018 in malaysia.

You can check on the tax rate accordingly. 2017 2 November 2 2016 1 June 1 2015 1. Rates of tax Personal reliefs for.

Individual Life Cycle. Saudi Arabia NIL 5 8 8 53. Malaysia personal income tax rates individual.

Introduction Individual Income Tax. Starting from year of. Tax Rates in Malaysia for 2016-2017 2015-2016 2014-2015.

Tax Rate Table 2017 Malaysia masuzi October 18 2018 Uncategorized Leave a comment 4 Views Malaysia personal income tax rates malaysia personal income tax rates. Malaysia Individual income tax rate table and Malaysia Corporate Income Tax TDS VAT Table provides a view of individual income tax rates and Corporate Income Tax Rates in Malaysia. Foreign-sourced income taxed upon remittance into Malaysia.

The following list illustrates the income tax rate for each taxable income group from the year 2010 assessment onwards. These will be relevant for filing Personal income tax 2018 in Malaysia. On the First 5000.

Individual tax rate 2017 malaysia.

Individual Income Tax In Malaysia For Expatriates

Which U S Companies Have The Most Tax Havens Infographic

Corporation Tax Europe 2021 Statista

Irs Announces 2017 Tax Rates Standard Deductions Exemption Amounts And More Irs Taxes Tax Brackets Standard Deduction

The State Of Tax Justice 2020 Eutax

Remember Some Tax Return Due Dates Are Different In 2017

Malaysian Personal Income Tax Pit 1 Asean Business News

The State Of Tax Justice 2021 Eutax

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

Spain Economy Facts Population Unemployment Gdp Business Trade

Brownies 1 Savory Snacks Tart Baking Microwave Recipes

7 Tips To File Malaysian Income Tax For Beginners

Individual Income Tax In Malaysia For Expatriates

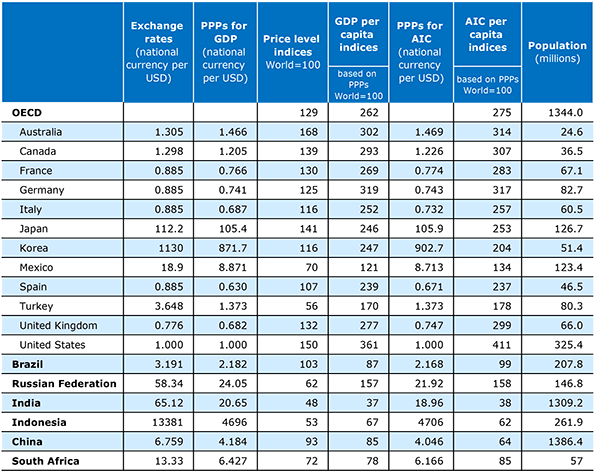

Oecd Share In World Gdp Stable At Around 50 In Ppp Terms In 2017 Oecd

Malaysia Payroll And Tax Activpayroll

Rates For Regular Gym Memberships At Miracles Fitness At The Garage Ocean View Gym Membership Fitness Membership Garage Gym

Remember Some Tax Return Due Dates Are Different In 2017

Taxes From A To Z 2017 O Is For Over The Counter Medicines